CDSPI Funds

A diverse lineup of low-fee investment funds rated #1 in performance*

Our Funds

Our diverse lineup of low-fee investment funds offers you a range of asset classes, investment managers and styles—with a history of strong long-term performance. CDSPI funds provide you with flexibility in meeting your investment goals, and our Investment Planning Advisors can help you choose what’s right for you.

What Sets CDSPI Funds Apart

CDSPI Fund Performance

*Segregated funds are governed under life insurance regulations and when there is a preferred beneficiary named may provide protection from creditors.

~Based on analysis by Morningstar Inc., of CDSPI funds, as of Apr. 30, 2021, with performance records of three years or more. Past performance is not necessarily indicative of future results. For more details on the calculation of Morningstar quartile rankings, please see morningstar.ca.

CDSPI Historic Fund Performance* ( as of April 30, 2025 )

Unit Values ( as of May 08, 2025 )

Funds

Granite Target Risk Funds

| Fund | Unit Value | Daily Price Change | 1 Year | 3 Year | 5 Year | 10 Year | MER† |

|---|---|---|---|---|---|---|---|

| CDSPI Granite Aggressive Portfolio (Sun Life) | 14.78020 | 0.08650 | 10.4 | 7.4 | 7.9 | N/A | 1.50 |

| CDSPI Granite Balanced Portfolio (Sun Life) | 13.38160 | 0.04550 | 9.5 | 5.8 | 5.7 | N/A | 1.50 |

| CDSPI Granite Conservative Portfolio (Sun Life) | 11.65360 | 0.00400 | 8.7 | 4.4 | 2.7 | N/A | 1.50 |

| CDSPI Granite Growth Portfolio (Sun Life) | 14.11640 | 0.06470 | 9.9 | 6.6 | 6.8 | N/A | 1.50 |

| CDSPI Granite Moderate Portfolio (Sun Life) | 12.64040 | 0.02950 | 8.7 | 5.1 | 4.5 | N/A | 1.50 |

Index Fund Portfolios

| Fund | Unit Value | Daily Price Change | 1 Year | 3 Year | 5 Year | 10 Year | MER† |

|---|---|---|---|---|---|---|---|

| CDSPI Aggressive Index Portfolio (BlackRock®) | 27.62780 | 0.13730 | 12.5 | 8.6 | 9.4 | 6.8 | 0.85 |

| CDSPI Conservative Index Portfolio (BlackRock®) | 21.02100 | (0.0111) | 10.2 | 5.3 | 4.0 | 3.7 | 0.85 |

| CDSPI Moderate Index Portfolio (BlackRock®) | 24.18220 | 0.05390 | 11.3 | 6.9 | 6.7 | 5.3 | 0.85 |

Income/Equity Fund Portfolios

| Fund | Unit Value | Daily Price Change | 1 Year | 3 Year | 5 Year | 10 Year | MER† |

|---|---|---|---|---|---|---|---|

| CDSPI Aggressive Growth Portfolio (CI) | 27.72350 | 0.36670 | 10.9 | 9.7 | 11.5 | 7.0 | 1.65 |

| CDSPI Balanced Portfolio (CI) | 23.16470 | 0.07990 | 9.2 | 7.0 | 7.2 | 4.8 | 1.65 |

| CDSPI Conservative Growth Portfolio (CI) | 24.69410 | 0.11380 | 9.7 | 7.9 | 8.8 | 5.5 | 1.65 |

| CDSPI Income Plus Portfolio (CI) | 20.69940 | 0.01910 | 7.9 | 5.3 | 4.7 | 3.6 | 1.65 |

| CDSPI Income Portfolio (CI) | 20.68720 | 0.01220 | 7.7 | 4.9 | 3.7 | 3.1 | 1.65 |

| CDSPI Moderate Growth Portfolio (CI) | 25.94120 | 0.14850 | 10.2 | 8.7 | 10.1 | 6.2 | 1.65 |

Corporate Class Funds

| Fund | Unit Value | Daily Price Change | 1 Year | 3 Year | 5 Year | 10 Year | MER† |

|---|---|---|---|---|---|---|---|

| CDSPI Canadian Bond Fund Corporate Class (CI) | 14.53120 | (0.08) | 7.8 | 2.5 | -0.6 | 0.8 | 1.10 |

| CDSPI Canadian Equity Fund Corporate Class (CI) | 29.74550 | 0.21850 | 9.0 | 7.6 | 13.7 | 7.4 | 1.65 |

| CDSPI Corporate Bond Fund Corporate Class (CI) | 23.37820 | (0.0082) | 7.5 | 4.7 | 3.9 | 3.2 | 1.25 |

| CDSPI Income and Growth Fund Corporate Class (CI) | 34.38680 | 0.14170 | 8.3 | 6.3 | 8.8 | 5.3 | 1.45 |

| CDSPI Short-Term Fund Corporate Class (CI) | 10.60890 | 0.00060 | 2.8 | 2.8 | 1.2 | 0.6 | 0.75 |

Guaranteed Fund Rates

| Fund | Rate |

|---|---|

| CDSPI 1 Year Guaranteed Fund (SLA) | 2.20000 |

| CDSPI 2 Year Guaranteed Fund (SLA) | 2.30000 |

| CDSPI 3 Year Guaranteed Fund (SLA) | 2.40000 |

| CDSPI 4 Year Guaranteed Fund (SLA) | 2.45000 |

| CDSPI 5 Year Guaranteed Fund (SLA) | 2.45000 |

* Average annual compound rate of return with all fees deducted. One to ten year performance for the period ending April 30, 2025. The above are historic results based on past performance and are not necessarily indicative of future performance.

† Plus applicable taxes.

Note: Fees may be levied for short-term trading.

BlackRock is a registered trade-mark of BlackRock, Inc.

Investment Resources

Tariff Update: Insights and analysis on the imposition of U.S. tariffs on Canada

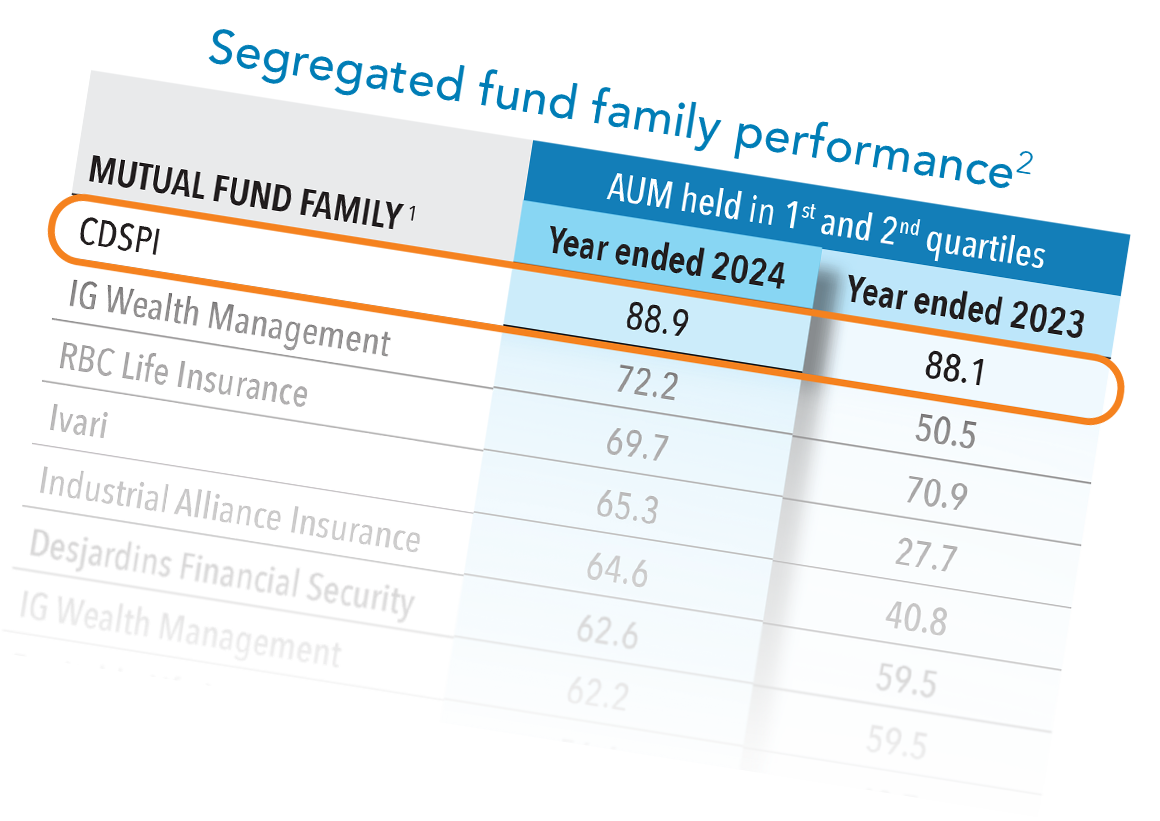

CDSPI Funds Top the Table for the Second Year in a Row!

A Grain of Salt

Debt: Minimizing Stress and Maximizing Benefits

A Market Update from Cumberland Private Wealth

Investing as a New Dentist – What You Need to Know

Passing Down the Family Cottage: An Interview with Shawna Perron

Don’t Pay Unnecessary Taxes: 6 Tax Minimization Tips for Dentists for 2024

Five Key Financial Considerations for Dental Grads

Consider Making Your Corporation Part of Estate Planning

Customize Your Retirement: Consider an Individual Pension Plan (IPP)

Demystifying Trust Funds for Dentists

Interest Rate Hikes Spark Interest in Annuities

Beyond the Stars: CDSPI Shines with Morningstar Ratings

Diversifying Your Portfolio: Understanding Asset Classes

Laddering: Safely Scale to New Financial Heights

![iStock-1824607496 [Converted] Teamwork to achieve highest results, brainstorming for income growth and business prosperity, cooperation or partnership to achieve goals and victory, mutual assistance and support, team work on arrow](https://www.cdspi.com/wp-content/uploads/RRSP-illustration.jpg)

Dollar-Cost Averaging: A Smoother Path to Success

The First Home Savings Account: Your Questions Answered

Let the Experts Manage Your Wealth so You can Manage your Life.

Escalators, Elevators and Swings. Advice for Riding the Stock Market.

Debt: Minimizing Stress and Maximizing Benefits

TFSA or RRSP? It Depends on Your Financial Plan.

TFSA Strategies

1 Catherine Harris, Best seg funds of 2024 leaned on Magnificent 7, March 13, 2025, Investment Executive. Past performance is not indicative of future results.

2 Segregated funds are governed under life insurance regulations and when there is a preferred beneficiary named may provide protection from creditors.