Financial Planning Tailored for Dentists

A blueprint for your financial future

CERTIFIED FINANCIAL PLANNER® professionals at CDSPI Advisory Services Inc are the experts in financial planning for dentists. We can help you navigate the distinctive challenges and opportunities you encounter as a dentist and will work with you to create a personalized financial plan that fits your unique situation and aligns with your goals and risk tolerance—all free-of-charge.

CDSPI can also co-ordinate with accounting and professional services experts from MNP where we have an exclusive agreement that gives dentists preferred pricing for many of their services.

Setting some time aside to assess your finances not only benefits your financial well-being today, it helps secure your future.

A Comprehensive Approach to Financial Planning

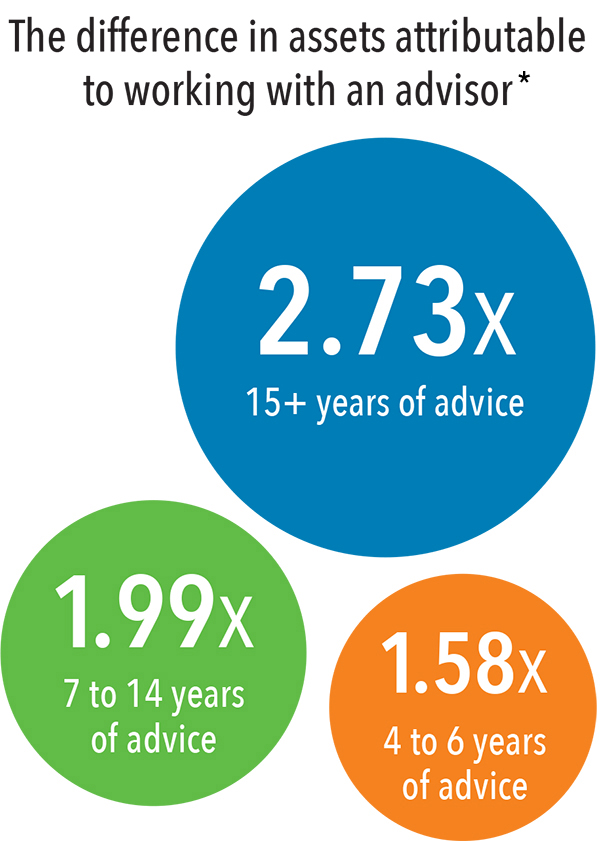

Strategic investment planning is one of the pillars of financial planning, and expert financial advice tailored specifically to dentists plays a critical role. Having a financial plan is the first step in gaining a comprehensive overview of your financial situation and creating a roadmap to achieve your goals. Managing your wealth requires balancing today’s financial needs with preparing for the future. By working closely with you, your advisor at CDSPI Advisory Services Inc, and our partners, we can explore how to effectively build and manage your assets.

Your financial plan needs to address complex considerations, including retirement savings, estate planning, insurance needs, and tax-minimization strategies, while also being cognizant of your objectives and priorities.

Our Investment Planning Advisors work with you to understand your risk tolerance, time horizon, target investment return, and the right asset allocation for you. Additionally, our diverse portfolio of investment funds offers a range of investment opportunities, giving you the flexibility to adjust your strategy as your needs evolve over time.

We recognize that your financial goals and preferences may change as you progress in your career and personal life. Our commitment is to provide you with the guidance and resources you need to navigate these changes confidently, ensuring that your financial plan remains aligned with your long-term vision. Whether you prefer a self-directed approach, discretionary or private wealth management, or you’d like to discuss your options with a professional advisor, we have options tailored to fit your needs and preferences.

Key Benefits of Financial Planning for Dentists:

When you work with an Investment Planning Advisor at CDSPI Advisory Services Inc., you benefit from personalized financial planning that aligns with your unique needs as a dental professional.

Here’s how you can benefit:

Personalized Goal Setting:

We help you identify and prioritize your financial goals, creating a roadmap to achieve them.

Investment and Insurance Support:

With our expert guidance, we help you make informed investment decisions that align with your risk tolerance and goals, while also evaluating your financial objectives to craft an insurance portfolio tailored to your short and long-term needs.

Manage and Reduce Debt:

We offer practical advice on paying down debt efficiently, freeing up more of your income for other priorities.

Market Fluctuation Management:

Stay on track even when financial markets are unpredictable with our ongoing support and advice.

Insurance Portfolio Assessment:

We evaluate your financial goals and craft a portfolio that suits your short and long-term objectives.

Buying or Selling a Practice:

For many dentists, their dental practice represents one of their most significant assets. Whether buying or selling, it is crucial to develop and implement a comprehensive plan well before the sale. CDSPI and our partners at MNP can help you thoroughly assess and address the financial and tax implications, as well as to devise a strategy for a seamless and successful transition.

Tax Minimization Strategies:

When your income exceeds $200,000, tax rates can reach 50% or higher, depending on your province. By leveraging strategies such as permanent life insurance, you can unlock cash in your professional corporation, reduce your tax liability, and improve tax efficiency.

The Right Advice Makes All the Difference

Specialized Expertise:

Because we work exclusively with the dental community, you can trust we understand the unique financial landscape you navigate as a dentist.

No-Cost Services:

Save between $2,500 and $5,000 with our complimentary financial planning services.

Objective Advice:

Our salaried advisors only provide investment recommendations that are in your best interests.

Comprehensive Planning:

Our services cover all aspects of your financial life, from debt management and tax minimization to investment growth and practice acquisition.

Learn

A Grain of Salt

Debt: Minimizing Stress and Maximizing Benefits

A Market Update from Cumberland Private Wealth

Investing as a New Dentist – What You Need to Know

Passing Down the Family Cottage: An Interview with Shawna Perron

Don’t Pay Unnecessary Taxes: 6 Tax Minimization Tips for Dentists for 2024

A new Cash back + Free trades offer from Qtrade

Five Key Financial Considerations for Dental Grads

We're Here to Help

1 Investment Funds Institute of Canada