A safe Investment Solution for Guaranteed Income

How would you like to have an investment that is considered safe and will pay you a guaranteed income every year for the rest of your life? Amidst today’s financial uncertainty, annuities are witnessing a resurgent popularity, catering to dentists who are seeking secure and stable solutions to safeguard their savings while ensuring a steady income stream with tax efficient options.

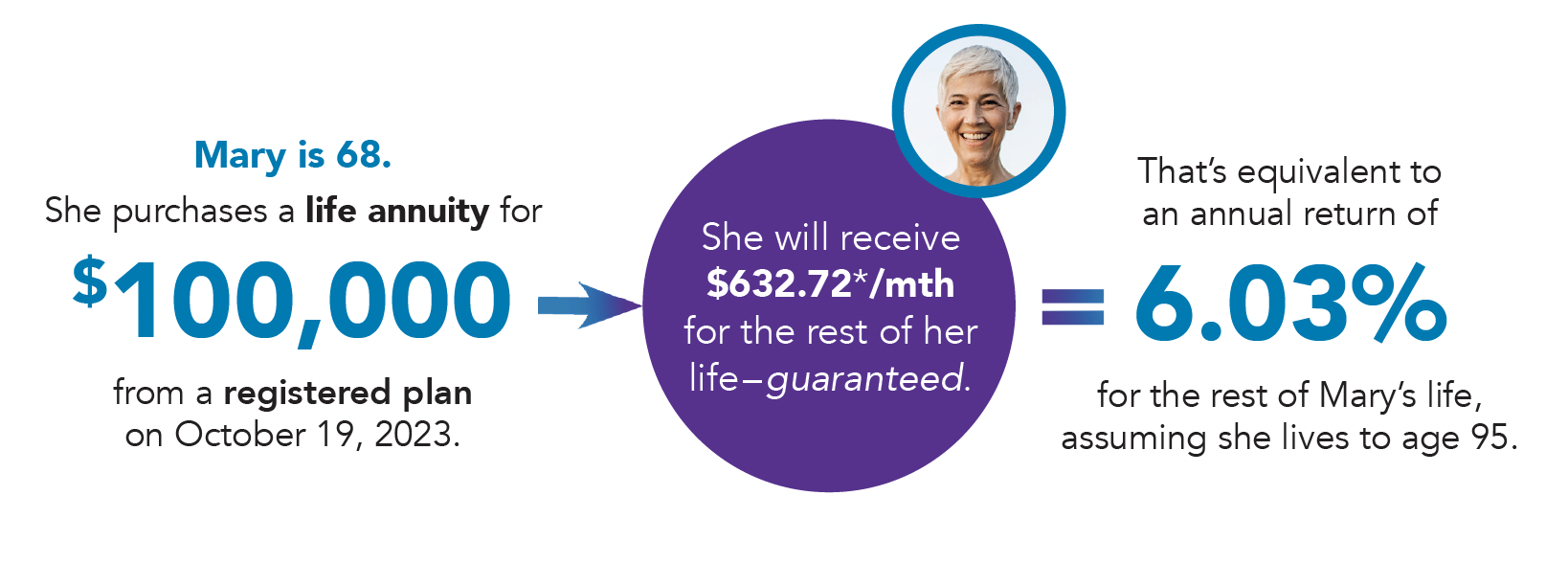

Annuities, offered by trusted insurance companies like Desjardins Insurance, Canada Life and Manulife have re-emerged as an attractive option because they provide a guaranteed source of income. If you’re looking for financial security over the longer term, annuities could be the answer.

28%

of clients are worried about outliving their investment portfolio.1

Understanding Annuities

An annuity is a financial agreement, or contract, between an individual investor and an insurance company. The individual purchases an annuity, either with a lump sum or multiple payments, and the insurer guarantees to pay out a steady income in return. The insurance company invests these funds and pays them back to the annuitant at regular intervals, determined by the annuitant. These income payments are typically based on factors such as life expectancy and prevailing interest rates at the time of purchase.

Similar to life insurance, annuities come in two types: term and life annuities. Term annuities offer a guaranteed income for a specific period, known as the guarantee period. This can be anything from one year to 50 years. At the end of the term, the annuity payments stop. Life annuities provide income payments until the annuitant’s death, regardless of when that occurs. Depending on factors like age and the source of funds, certain restrictions may apply.

For both, the periodic payment amount is fixed at the time of purchasing the annuity and is not affected by market fluctuations or declining interest rates. Investors also have some options as to how the money used to purchase the annuity is invested. For example, Desjardins Insurance has a responsible investing annuity which incorporates environmental, social and governance factors into the selection and management of their investments.

What Are My Options?

Most annuities allow the inclusion of options to meet individual preferences and needs. Some of the more common ones include:

Annuity Payment Guaranteed Period:

Annuity holders can choose a specific guarantee period (e.g., 10 years) or extend it until a specified age. After this period, the annuitant will continue to receive payments as long as they live. If the annuitant dies within the guarantee period, their beneficiary continues to receive payments until the end of the guarantee period.

Joint and Last Survivor Option:

Ensures that the payments continue for the lifetime of the surviving spouse after the annuitant passes away.

Indexation Option:

Gradually increases the payment amount every year, usually by a fixed percentage (e.g., 3%) to help account for inflation.

Cash Refund Option:

A beneficiary receives the difference between the single premium paid to purchase the annuity and the total payments made to the annuitant upon their death.

Annuities have become an attractive financial tool for investors seeking guaranteed income, stability, and security. With various options available to suit individual needs, annuities offer a compelling alternative to traditional investment options.

There are many reasons why an annuity may be a good investment for you. These are just a few of the benefits that annuities can offer:

Guaranteed Income for Financial Security:

Annuities offer a reliable income stream, providing financial security and stability.

Protection Against Market Fluctuations:

Unlike investments exposed to market volatility, annuities offer a haven from market fluctuations.

Support for Longevity:

With life annuities, you are protected from outliving your savings.

Financial Empowerment for a Lifetime:

Annuities promote financial empowerment by securing a steady income stream even after regular employment income ceases.

Flexibility in Surrendering Annuities:

Should the need arise, annuities can be “surrendered” for their cash value.

Beneficiary Protection:

With a term annuity, if the annuitant passes away before the guarantee period ends, the designated beneficiary will receive any remaining payments. With a life annuity, there are options that can be chosen to provide money to a beneficiary or estate, or to transfer payments to a surviving spouse/partner.

With inflation and the rising cost of living, annuities keep your income secure from both market risks and changes to interest rates. To determine if an annuity is suitable for your needs speak with an advisor from CDSPI Advisory Services Inc.

1 Environics Research is an independent Canadian polling and market research. The anonymous survey focused on retirement and was conducted online in August 2021.

* Rate calculations are as of October 19, 2023. Rates are subject to change.

Restrictions may apply depending on the annuitant’s age or the source of the funds.

Spouse refers to a legally married spouse or a common-law partner.

The current value, or discounted value, refers to the value at the time of death of any annuity payments that would have been made in the future.

If the guarantee period has ended, the beneficiary will no longer receive payments.

DESJARDINS INSURANCE refers to Desjardins Financial Security Life Assurance Company. DESJARDINS INSURANCE and its logo are trademark of the Fédération des caisses Desjardins du Québec used under licence. 200 Rue Des Commandeurs, Lévis QC G6V 6R2 / 1-866-647-5013.

The information contained in this article is of a general nature only and should not be considered personal insurance, investment or financial advice.

For specific advice about your situation, please consult with your financial advisor.